...

Is Farm Owners Academy a cult?

At our last TOP Producers event, a farmer approached me and mentioned that he had heard Farm Owners Academy being referred to as a ‘cult.’ To my surprise, when asked directly, I responded, “Well, in many ways, it is.”

Allow me to explain.

The term “cult” is derived from the word “culture.”

Culture can be defined as a new way of thinking. Just like successful sports teams that cultivate a strong culture (or cult), one could argue that your favorite sports team is also a cult. The top teams excel in creating fanatical supporters who are passionate about their mission and what they do.

Similarly, great businesses also embody cult-like characteristics. They establish a culture that attracts and retains talented individuals. Team members become deeply committed to the organization’s mission and are passionate about their work.

In essence, at Farm Owners Academy, we do encourage a different way of thinking.

Times have changed, and traditional notions of running a farm, such as believing that you must be the hardest working person and should invest all profits to avoid taxes, no longer serve everyone.

We acknowledge that Farm Owners Academy may not be suitable for everyone, nor have we ever claimed to be. However, for those who are open-minded, humble, seek help, and wish to become the best version of themselves, working with us will feel like home.

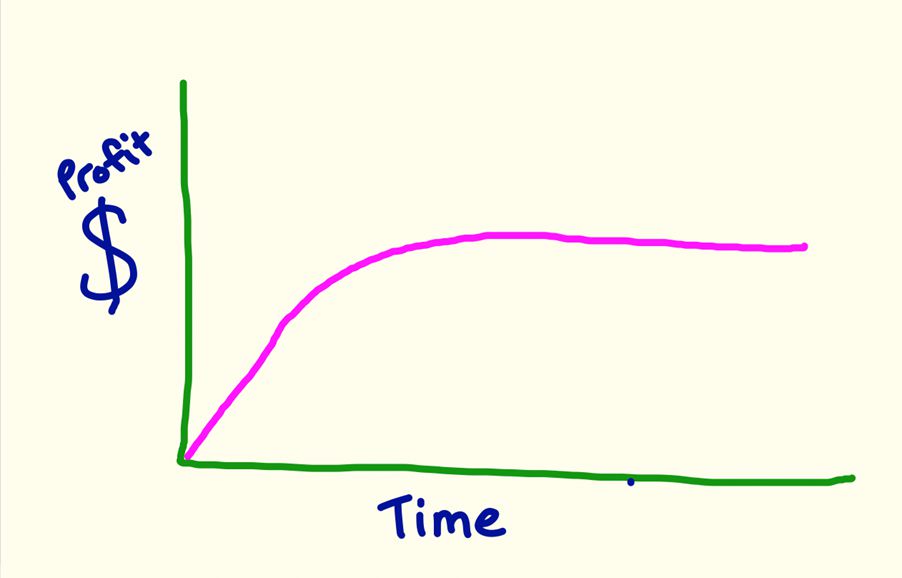

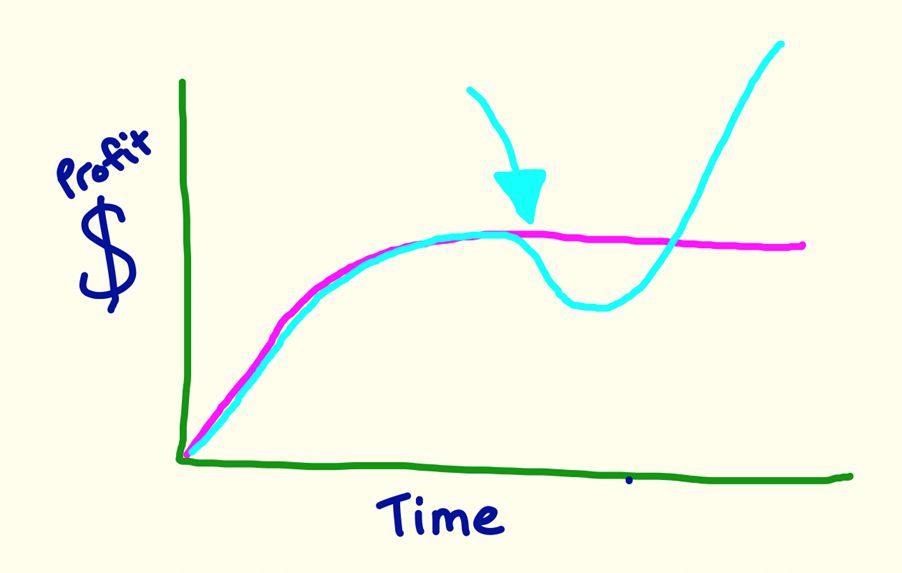

We are dedicated to teaching you how to build a sustainable business, rather than just creating a job for yourself. Our focus is on making your business highly profitable, even during challenging times, which may result in paying more taxes. However, we believe that being financially successful and contributing to society through taxes is a crucial part of building a thriving business.

Once your business is thriving, we guide you in systemizing your operations, enabling you to delegate tasks and responsibilities to a competent team. This allows you to reclaim your time and focus on the aspects of farming that truly matter to you.

Moreover, we go beyond the boundaries of the farm by showing you how to invest your money outside of your farming business. Our aim is to help you generate passive income, providing you with financial security and freedom. We call this approach the “Freedom Farmer” lifestyle, where you have a business that operates efficiently without your constant involvement, granting you the freedom to pursue other passions or interests or giving you the freedom to farm because you want to, not because you have to.

Did you know that the farms we benchmark have more than $2 billion worth of assets under management each year?

For those who register for our free webinar in June, we have a special bonus training for you called “Beyond Average: How Australia’s Top Farmers Outperformed the Rest Last Year with Data from One of Australia’s Largest Benchmarking Companies.”

During this presentation, we will analyze the latest data and insights from this extensive benchmarking set of high-performing farm owners. We have compiled data from hundreds of farms across the country to identify the key factors that distinguish the top 20% of farmers from the rest. We will delve into the numbers and uncover the specific strategies and practices that successful farmers used to outperform their peers. These valuable insights can be applied to your own farming business. The value of this training is estimated at $500 and will be gifted to those who register and attend the free training. Click here to register for this free training session or find out more information.

At Farm Owners Academy, we foster a culture of continuous improvement and strive to provide farmers with the knowledge, tools, and support they need to thrive in the modern business landscape.

Have a great day,

Robbo

P.S. Find our more about our free training series or secure your seat – click here!

Building Resilience

Breaking Free from Scarcity: The Abundant Mindset in Farming’s Tough Times

...

Book review – The Practicing Mind

...

3 things to consider if you are going through a cash flow crisis

...

How these farmers went from working 7 days per week to 5 months off

...

The power of asking a good question

...